Table of Content

- Line of Credit Interest Rates

- Borrowing amount and available home equity

- How can I use my home equity?

- Are home equity loan rates higher than mortgage rates?

- How does a HELOC differ from a home equity loan?

- Which is better: A HELOC or a home equity loan?

- Shore Up Your Credit Before You Take Out Home Equity

Suzanne De Vita is the mortgage editor for Bankrate, focusing on mortgage and real estate topics for homebuyers, homeowners, investors and renters. Before joining Bankrate in 2020, he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. When you have to rush to make a connecting flight, so does your bag, and that’s just one more stop where things can go wrong. Of course, not everyone has the luxury of living near a well-connected airline hub, but you can still be selective about which airports you connect through. For example, suppose you can choose between a connection in Dallas Fort Worth or Newark for your January return flight.

A personal LOC is an unsecured, set amount of funds from which an individual can borrow, repay, and re-borrow for a given period of time. Because the lender has more certainty of getting the money back, a secured LOC typically comes with a significantly higher credit limit and lower interest rate than an unsecured LOC does. To obtain a line of credit, borrowers must first apply for and be approved by a financial institution.

Line of Credit Interest Rates

Contrary to a standard mortgage, HELOCs are interest-only, are not amortized, do not consist of terms and finally, rates fluctuate according to the prevailing prime rate. HELOCs often have a borrowing limit of 80-90% of your home equity. So, if you have $50,000 in equity, you might be able to obtain a credit limit of between $40,000 and $45,000. The amount you borrow may also impact the interest rates you qualify for. Several factors affect HELOC rates, including the Federal Reserve federal funds rate, the interest rate at which banks lend money to each other. In March 2022, the Federal Reserve raised interest rates for the first time since 2018 and announced that it would raise the target federal funds rate incrementally over 2022.

Along with their flexibility, HELOCs allow you to borrow as much money as you need. This is great if you aren’t sure how much money your project or investment will cost in the long run. So if a project ends up being under budget, you won’t have to worry about paying more than necessary in interest. HELOCs can be useful financial tools, but they’re not ideal for every financial situation. Here are the most important disadvantages and advantages to be aware of before applying for a HELOC loan so you can make the best choice for your needs. As an independent insurance agency, we shop for you to find the best coverage and rate for your situation.

Borrowing amount and available home equity

A home equity loan can give you a lump sum of cash at a low interest rate, but you must use your home as collateral to secure the loan. Economic indicators include the current prime rate and federal funds rate, both of which affect HELOC rates. Indicators like inflation, as well as market supply and demand can also impact rates.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. We are an independent, advertising-supported comparison service. Consider a cash-out refinance loan to get the financing you need. Learn about a HELOC, how a variable rate is calculated and how to get a Fixed-Rate Loan Option.

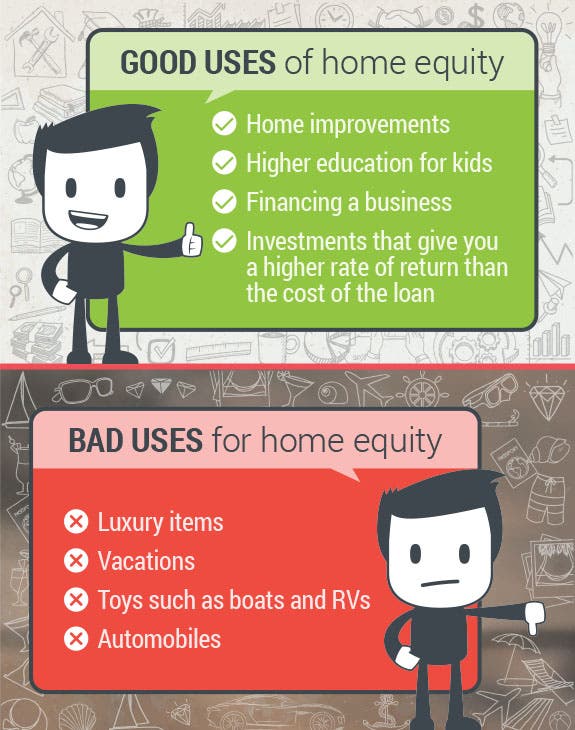

How can I use my home equity?

A home equity loan can affect your score positively or negatively depending on how responsibly you use it. As with any loan, if you miss or make late payments, your credit score will drop. The amount by which it will drop depends on such factors as whether or not you've made late payments before. Average home equity loan rates are currently 7.8%, which is higher than the average rate for a 30-year fixed mortgage at 6.78%. Another benefit of a mortgage is that you will have the option to choose between fixed or variable terms.

6 Intro 3.99% APR available on loans for owner-occupied primary residences with loans up to 70% Loan-to-Value and credit scores of 680 or higher. Rate is locked for 12 months, then set at Prime (recently 7.50%) minus 0.50 percentage points, or 3.99% APR, whichever is higher. Rate is subject to change after 12 months from closing date, and thereafter on the first business day following any change in the Prime Rate as published in the Wall Street Journal. Additional introductory rates and loan programs may be available.

Are home equity loan rates higher than mortgage rates?

Lenders usually want to see at least a 620 credit score or higher. You can be denied for a HELOC if you don't have a high enough credit score or income. You can also be denied if you don't have enough equity built up in your home.

If you have a $200,000 line of credit and you spent $30,000 on a car, you would only pay interest on the $30,000, not the full $200,000. You can take out a line of credit and spend it on anything you like, from home renovations, a holiday or car, to even funding another property purchase or investment. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision. Home improvements - Using your home equity to pay forhome improvement projects that increase the value of your home can be a smart move. Flagstar has flexible loan amounts that range from as little as $10,000 to as much as $500,000.

While not exactly cheap to hold at $250 per year, its annual fee can quickly be recouped through annual dining credits. Plus, travelers will appreciate its decent range of travel and shopping protections. Generally, premium rewards cards offer the broadest coverage. However, even premium credit cards have exceptions in place when it comes to jewelry, electronics and other high-value items.

If you want more information on line of credit home loans, you might want to speak to your existing lender or mortgage broker for more information on your specific circumstance. Is a line of credit still offered as a product to personal banking customers? From a lender's point of view, it has the security of your home in the event you default on the loan.

See expert-recommended refinance options and customize them to fit your budget. In this scenario, you could potentially get a credit limit of up to $20,000. Apply online for expert-recommended options customized to your budget. Make sure you review each to get the best understanding of the options available to you. You are now leaving Mid Minnesota Federal Credit Union's website. MMFCU is not responsible for the content or availability of linked sites.

The interest rate is often lower than other forms of credit, and the interest you pay may be tax deductible, but you should consult a tax advisor. Much like a credit card, a HELOC is a revolving credit line that you pay down, and you only pay interest on the portion of the line you use. You’ll continue to pay principal and interest on what you borrowed. The other component of a variable interest rate is a margin, which is added to the index. The margin is constant throughout the life of the line of credit.

Bankrate's home equity line of credit rate offers help you compare interest rates, fees, terms and more as you start your search for a loan. The resources below also serve as a starting point for learning about how home equity works and when a HELOC is a good option. For instance, you’ll get Priority Pass Select lounge membership, up to $100 in Global Entry and TSA PreCheck credits and up to $300 in qualifying travel credits per year. For starters, many top rewards credit cards already include some surprisingly comprehensive travel protections, including insurance coverage for baggage mishaps. Two types of luggage insurance typically offered include incidents of lost baggage and baggage that is severely delayed by several hours. For delays, that means your credit card issuer will often reimburse you for any necessities purchased while you wait for your bag to turn up.

Some will go up to 90% or even 95%, but an 80% limit is far more common. Choosing between aHELOC and a home equity loancomes down to your financial situation, needs and priorities. While HELOCs and home equity loans are similar in some ways, they have a few distinct differences. These are some of the key factors you should consider whendeciding between a HELOC and a home equity loan.

No comments:

Post a Comment