Table of Content

All information presented should be independently verified through the references given below. As a general policy, Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US. The environmentalist movement and California are intertwined in the public’s mind and for good reason. An estimated 85 percent of the county is off-limits to development. It means that there are large estates that cannot be turned into tract homes. This is why George Lucas had to threaten to build hundreds of homes on Skywalker Ranch when they wouldn’t let him expand his studios there.

Total construction spending rises despite falling single-family spending. September construction spending was up 0.2%, boosting the year-to-date total by 11.4%. September's growth was helped by a minor increase in nonresidential construction spending and a slowdown in residential spending, which had fallen for 3 months. But higher mortgage rates also mean that sellers are less inclined to list their home and go back into the market themselves, meaning that inventory growth is likely to remain sluggish. Divounguy said that would keep prices from dropping even more than what is forecast.

Why Bay Area Home Prices (Probably) Won’t Drop in 2022

You will find first-time homebuyers who are buying over $2.5 million or baby boomers looking for second homes in the $2 million range. However, the reality is that the pool of people who can afford to buy is smaller and smaller and the supply of housing is not growing with demand. They mostly consist of luxury condos and mega-mansions built for the elite of the Big Tech workforce. You may read about the growth of Portland and other Pacific Northwest cities as talent and businesses flee the expensive San Francisco real estate market. However, San Francisco has several advantages over its Oregon rivals, and that’s the fact that you aren’t in Oregon.

Bellomo said buyers are still looking for extra space due to the continued availability of remote work; they want that coveted “Zoom room” if they can get it. But even with the increased popularity of remote work, and thus a need for closed-off spaces, open-concept homes are still preferred by buyers, according to the HomeLight survey. But the figure that may best signal how good a condo deal could be right now is the percentage of homes selling for over the asking price.

Breaking News

Still, home prices in both metros remain elevated compared to previous years. The map above shows which ZIP codes in the region have seen the largest increases over the past year. Of 159 ZIP codes in the data, 22 had negative price growth, including in Annapolis, Sonoma County, and 94601, representing east Oakland. “It is an excellent time for buyers to aggressively negotiate home purchases at prices well below those of recent years. … There are deals to be made here for buyers with the financial resources and a longer-term view,” Carlisle said. Home sales in Solano and Sonoma counties have taken the biggest hits from rising mortgage interest rates, but deals in Marin and Napa counties are down dramatically, say California Association of Realtors data Friday.

Earlier this month, the mortgage-buying corporation Freddie Mac published its latest forecast for the housing market. They predicted that home prices nationwide would end up rising by 16.9% in 2021, followed by a gain of around 7% in 2022. The first-quarter 2022 figure is less than half of the affordability index peak of 56 percent in the first quarter of 2012. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales. Like the other places on this list, Durham, along with nearby Raleigh, NC, has seen big price increases in recent years.

Bay Briefing: Home prices are officially dropping in the Bay Area

For example, the laws governing the San Francisco real estate market allow you to buy San Francisco rental properties and evict the tenants to turn the units into condos for sale. Even with higher interest rates adding to the cost of a mortgage, the overall prices on homes may be lower. In a recent survey of real estate agents from real estate tech company HomeLight, only 30% of respondents said their market was a seller’s market in the fourth quarter of 2022. This is a swift decline from the 95% of agents who said they were in a seller’s market in the second quarter of 2022. A supply-demand imbalance will continue to put upward pressure on prices, but higher borrowing rates and partial adjustment of the sales mix will likely limit the median price rise.

She previously interned The Chronicle on the Business desk, as well as at Big Local News, focusing on data journalism. “The Bay Area has taken somewhat of a lead in price declines, but I think we’ll see the rest of the country come into parallel,” Carlisle said. “Power has shifted — finally — from sellers to buyers, so buyers should feel very comfortable negotiating very very aggressively,” he said. Gwendolyn Wu is the writer of The Chronicle's flagship newsletter, Bay Briefing, and an engagement reporter.

The San Francisco Bay Area had a year-over-year price decline of 2.0 percent, with the median price being $1,250,000. But she and other longtime residents didn’t expect prices to rise as much as they did over the past few years. Prices rose nearly 36% from March 2020 to the peak in June in the Spokane metro area. Homeowners might have felt like they had been holding a pair of aces earlier this year, when home values were up 25% over the year before. But the nearly 8% drop in prices in recent months has wiped out most of those gains.

It is calculated by taking all estimated home values for a given region and month , taking a median of those values, and applying some adjustments to account for seasonality or errors in individual home estimates. Multifamily and home improvement spending grew 0.3% and 2.9% respectively, while single-family spending dropped 2.6%. Single-family spending has fallen for four straight months as rising borrowing costs impact building. The Fed approved a 0.75-point rate raise for the fourth time this year, but it may be the last. The latest hike pushed the target range to 3.75-4%, the highest since January 2008.

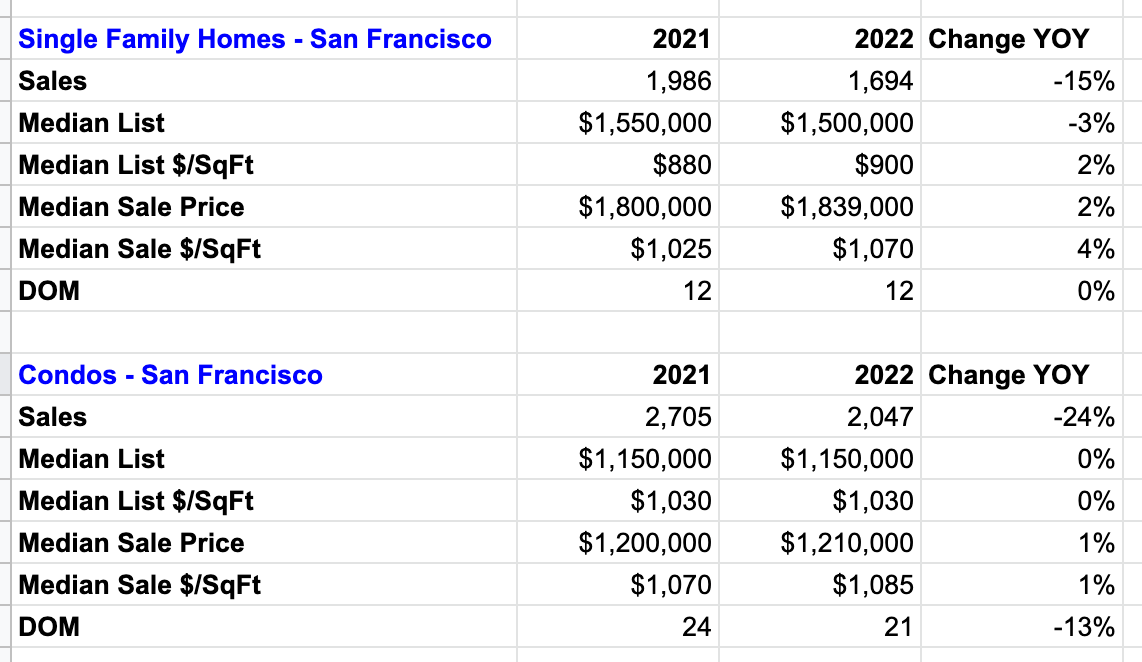

The median home price in California is expected to drop 8.8 percent to $758,600 in 2023, after rising 5.7 percent to $831,460 in 2022 from $786,700 in 2021. Next year's median price rise will be slowed by a less competitive housing market for homebuyers and a stabilization in the mix of home sales. The median sale price for a Bay Area home last month was $1.25 million, which is 0.5% less than September's price of $1,256,500. It is the price in the very middle of a data set, with exactly half of the houses priced for less and half-priced for more in the Bay Area real estate market. It shows that the Bay Area housing market is distinguished by high demand and a scarcity of available inventory. Due to persistent demand from the state's high-income residents, home prices have skyrocketed in this market over the past few years.

Ironically, this creates significant returns for those who buy up San Francisco rental properties and can convert them to multi-family housing. As a move to support affordable housing initiatives, these investments will help Google plans to give $50 million in grants through Google.org to nonprofits focused on the issues of homelessness and displacement of citizens. From March 2020 through October 2022, the median home value in the U.S. surged from about $252,000 to nearly $358,000, according to Zillow data— a 42% increase. Meanwhile, Redfin numbers show some prospective homebuyers are getting cold feet. The real estate website reports 23% of those who signed a contract to buy a home in Northern California backed out of the deal -- that is double the number from last year.

But they clearly don’t expect Bay Area home prices to drop in 2022. In fact, according to one index, housing prices in the city by the Bay dropped faster in August than in any other city in America - a 4.3 percent decline since July. Nearly every Bay Area county saw a drop in median home prices for single-family homes in June 2022 when compared with May, with Marin County seeing the sharpest dip at 14.3%. Alameda County also saw a significant drop at 8.1%, while Napa County saw a 7% decrease and San Francisco County saw a 5.7% decrease. Housing costs have been on the rise in California, which has impacted affordability.

Again, real estate forecasts like these are the equivalent of an educated guess. No one can predict future real estate or home-price trends with complete accuracy. But we seem to have all of the ingredients needed for continued appreciation into 2022. As a result, it seems highly unlikely that Bay Area home prices will drop anytime soon. This is one of the main reasons why Bay Area home prices probably won’t drop later this year or 2022. A stark imbalance between supply and demand will continue to put upward pressure on house values, at least for the foreseeable future.